Saving for retirement should bring peace of mind. But when your pension is from outside the United States, the rules are not always clear. What works as a normal retirement plan in another country often looks very different to the IRS. For U.S. citizens and residents, this creates real concerns. Money you set aside tax-free overseas may be taxable here. Even the payments you receive can raise questions about being taxed twice. The challenge is not only reporting the income but also knowing when treaty rules, credits, or extra forms apply.

This blog post clearly answers the question many people have in mind as they ask, Are foreign pensions taxable in the US? It also explains how foreign pensions are taxed in 2025 and highlights the key points you need to understand before reporting your income and staying compliant.

Understanding Foreign Pension Taxation: Are Foreign Pensions Taxable in the US?

Most foreign pensions are taxable in the United States. If you’re a U.S. citizen or resident, the Internal Revenue Service (IRS) requires you to report all worldwide income. That includes retirement income earned through a foreign pension, even if it’s paid in another currency, held overseas, or considered tax-deferred under the laws of another country.

Whether you’re living in the U.S. or you are a U.S. expat, receiving payments, or letting your account grow, the U.S. tax system may still apply. There are a few exceptions, such as certain treaty-covered pensions, but they are specific and limited in scope. However, knowing that your foreign pension is taxable isn’t enough. It’s crucial to understand how the IRS views these pensions, as this determines how the income is taxed and if it’s even considered a pension.

Definition of Foreign Pension Plans

A foreign pension plan is any retirement arrangement established under the laws of a country outside the United States. These plans are meant to provide retirement income, but they don’t follow U.S. tax rules. They may be employer-sponsored, run by a foreign government, or set up privately. What matters is that they are not U.S.-qualified plans like a 401(k) or Individual Retirement Accounts (IRA), and that means they’re usually treated differently when it comes to taxation, contribution limits, and annual reporting.

Types of Foreign Pensions Subject to U.S. Tax

Before you can report your pension properly, you need to understand what type of plan you’re dealing with. The structure of your pension determines whether it’s taxed now or later, whether investment gains are taxable each year, and whether you’re required to file additional IRS forms. This section helps you identify the common types of foreign pensions that the IRS typically looks at and gives you a sense of where your plan might fall.

- Defined Benefit Plans: These promise a fixed monthly payment in retirement, based on salary and years of service.

- Defined Contribution Plans: The value depends on contributions and investment growth over time. Think of it as a foreign version of a 401(k).

- Government Pensions/Social Security-Type Programs: These are public retirement programs funded by payroll taxes in countries like Canada, the UK, or Germany.

- Private Retirement Accounts or Schemes: These are individually held investment accounts set up for retirement purposes, often with no employer involvement.

Each type comes with different tax implications, especially when it comes to deferral, reporting, and treaty coverage.

How Does U.S. Tax Treatment Differ From U.S. Pensions?

This is where most taxpayers are caught off guard, because foreign pensions often look like a 401(k) or IRA, but the IRS doesn’t treat them that way. Here’s what makes them different and why it matters:

1. You don’t get a deduction for contributions

Even if contributions are required in your home country or made by your employer, the IRS generally does not allow you to deduct them on your U.S. tax return. That means you’re paying tax now on income you’re setting aside for retirement.

2. You may owe tax on annual growth

With a U.S. retirement plan, investment earnings grow tax-free until withdrawal. However, with most foreign pensions, the IRS may tax the earnings inside the plan each year, even if you haven’t received any payments yet. That’s because the account doesn’t qualify for automatic deferral under U.S. rules.

3. Distributions are taxed like annuities

When you start taking money out, the IRS treats it like an annuity. You can recover your after-tax contributions (called your basis), but the rest is taxed as ordinary income, not capital gains. This can affect your total tax rate in retirement.

4. You need a treaty to change that

Some tax treaties may eliminate tax on certain types of foreign pension income (such as government pensions, social security), allowing you to defer tax or reduce the amount subject to U.S. tax. But unless your plan is covered by a treaty, and unless you file the right forms (like Form 8833), you won’t get that benefit.

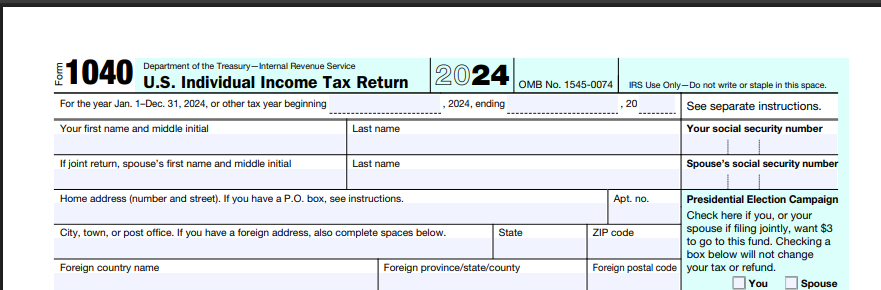

How to Report Foreign Pension Income on Form 1040?

If you received payments from a foreign pension or retirement plan during the year, you must report that income on your Form 1040, even if the plan is tax-deferred in its home country. The only time you may be able to avoid reporting or taxation is if a U.S. tax treaty specifically allows it.

Here’s how to report a pension on Form 1040 correctly, step by step:

Step 1: Add the Pension Amount to Form 1040

Report the full amount received from the foreign pension on Line 5a. And report only the taxable portion on Line 5b. If you contributed to the plan with after-tax dollars (your “basis”), that part is not taxable and should be excluded from Line 5b.

Step 2: Convert Foreign Currency to U.S. Dollars

If your pension payments were in another currency, convert them to U.S. dollars. You can use either:

- The IRS’s average annual exchange rate, or

- The daily exchange rate on the date you received each payment

Step 3: Determine If a Tax Treaty Foreign Pension Applies

Some countries (such as the United Kingdom, Canada, and Germany) have tax treaties with the U.S. that may reduce or eliminate tax on certain types of foreign pension income (such as government pensions, social security-type pensions, and employer-sponsored retirement distributions). If you’re claiming a treaty benefit, you may need to file Form 8833 to disclose it.

Step 4: Understand the Type of Income

Foreign pension income is usually considered unearned income by the IRS. This means it does not qualify for the Foreign Earned Income Exclusion, which only applies to earned wages and salaries.

Step 5: Keep Supporting Documents Ready

Hold on to important records such as

- Year-end statements from your foreign pension provider

- Proof of any after-tax contributions

- Foreign tax statements, if any

- Employer letters or certification documents, if applicable

Once you’ve gone through the reporting steps above, there’s one more piece to get right: making sure you attach the right forms and schedules when filing your tax return. These forms support your foreign pension reporting on Form 1040—and help ensure your return is complete, accurate, and audit-ready.

Required Supporting Forms and Schedules

Here are the additional forms you may need to include, depending on your specific situation:

1. Form 1116: Foreign Tax Credit

If you paid taxes to a foreign country on your pension income, you may be eligible to claim a foreign tax credit using Form 1116. This helps reduce your U.S. tax by the amount of foreign tax paid, so you don’t get taxed twice on the same income. Attach it to your Form 1040 when claiming the credit.

2. Schedule B: Interest, Dividends, and Foreign Accounts

If your foreign pension is held in a foreign financial institution or you received distributions from such an account, you’ll need to complete Schedule B (Part III). This section asks whether you have a financial interest in or signature authority over a foreign account and whether you’re required to file Report of Foreign Bank and Financial Accounts (FBAR) separately.

3. Form 8833: Treaty-Based Return Position Disclosure

If you’re reducing your taxable pension income under a tax treaty, the IRS requires you to disclose that position using Form 8833. This is especially important when you’re not following the standard tax rules due to a treaty benefit. File this form along with your return unless your situation qualifies as an exception.

Foreign Retirement Income Tax Calculations

Getting foreign retirement income tax calculations right is important as it decides how you can manage your foreign retirement income, how much income you report, and how much tax you actually pay.

Determining Taxable vs. Non-Taxable Portions

When you receive money from a pension, part of it may already have been taxed in the past, while the rest counts as new taxable income. The calculation helps you avoid paying tax twice on the same money.

The general formula is:

Gross Distribution − Cost Basis = Taxable Portion

Example: If you withdraw $20,000, and $5,000 represents contributions you already paid tax on, only $15,000 is taxable.

Some pensions may allow a simplified method, where each payment is divided between taxable and non-taxable parts based on a set percentage. The method you use depends on the records you keep and how the pension plan is structured.

Cost Basis and Investment Recovery

Your cost basis is what protects you from being taxed on your own money again. It represents the contributions you made with after-tax dollars and, in some cases, employer contributions that were already included in your income for U.S. tax purposes.

- Employee contributions: If you paid tax on them when you earned the income, they add to your basis.

- Employer contributions: If they were taxed in the U.S. when made, they also add to your basis.

- Recovery over time: Each distribution lets you take back some of this basis tax-free until it’s fully used.

Keeping good records of your contributions and any amounts already taxed in the U.S. ensures that the IRS doesn’t treat those same amounts as taxable again.

Annual Accrual Taxation Rules

Taxation of foreign pensions doesn’t always wait until retirement. In many cases, the IRS treats the growth inside the account interest, dividends, or capital gains as taxable each year, even if you didn’t receive a payment. This becomes even more complex if the pension holds foreign mutual funds or pooled investments, because they can be classified as Passive Foreign Investment Companies (PFICs). PFIC rules are some of the toughest in U.S. tax law and can create extra forms and higher taxes.

- You may need to file Form 8621 if your pension holds Passive Foreign Investment Companies (PFICs).

- Delayed reporting of PFIC income can lead to additional tax and interest charges.

This means that even if you leave your pension untouched, the IRS may still expect annual reporting and possibly tax on its internal growth.

Tax Treaty Benefits and Foreign Tax Credits

For many people with foreign retirement income, the biggest concern is paying tax twice, once to the country where the pension is earned and again to the United States. U.S. tax law offers two main ways to deal with this: tax treaty benefits and the foreign tax credit. Both aim to reduce double taxation, but they work differently and have different filing requirements.

Available Tax Treaty Provisions

Tax treaties can change how pensions are taxed, and in some cases, they can lower or even remove U.S. tax on certain types of retirement income. These rules are not the same in every treaty, so it’s important to know what your specific treaty allows. Common pension-related treaty provisions include:

- Private pensions: Often taxed only in the country where you live as a resident.

- Lump-sum distributions: Some treaties say lump-sum payouts are taxable only in one country, not both.

- Government pensions: Usually taxed by the country paying them, unless the person is a resident and national of the other country.

- Social security-type benefits: Many treaties give taxing rights to only one country, often the country of residence.

- Recognition of foreign contributions: Some treaties let you defer U.S. tax on contributions made while working abroad.

- Relief and dispute resolution: All treaties include articles on double taxation relief and “Mutual Agreement Procedures” (MAP) if both countries claim the same income.

If you use a treaty to change the normal U.S. tax rule, you usually must file Form 8833 to disclose your treaty position.

Foreign Tax Credit Calculations

When a treaty doesn’t apply, the foreign tax credit (FTC) is the main way to prevent double taxation. It lets you reduce your U.S. tax bill by the amount of income tax you already paid to another country on the same pension income. The credit is figured on Form 1116:

- List the foreign taxes you paid on your pension. Only income taxes (or those in place of income taxes) qualify.

- Report the income in the correct category. Pension income is usually “general category income.”

- Apply the FTC limitation formula:

Your allowable credit = (U.S. tax liability × foreign-source taxable income ÷ worldwide taxable income)

- Use carryovers. If you can’t use all the credit this year, you can carry it back 1 year or forward up to 10 years.

- Remember treaty limits. If your treaty provides for a reduced withholding rate, only that reduced amount counts for the credit.

This credit is especially helpful for retirees in higher-tax countries like Germany, the U.K. , or Canada, where foreign taxes often exceed U.S. tax.

Choosing Between Treaty Benefits and Credits

Both treaty benefits and the foreign tax credit aim to reduce double taxation, but they are not used at the same time. The choice depends on your income mix and where you live.

- Treaty benefits may exclude or defer pension income, but usually require filing Form 8833.

- Foreign tax credits work best when you are already paying high taxes abroad, since they directly offset U.S. liability.

- The better choice depends on your total tax picture, including wages, investments, and other income.

Taking the time to compare the two can prevent paying more tax than necessary and set a consistent plan for future filings.

Reporting Requirements and Compliance Forms

Reporting foreign retirement income on your tax return is only part of the job. The U.S. has strict rules for disclosing foreign financial accounts and trusts, and these rules apply even when no tax is due. Missing a required filing can lead to heavy penalties, so it’s important to know which compliance forms apply to your pension.

Form 3520 and 3520-A Trust Reporting

Some foreign pensions are structured as foreign trusts under U.S. tax law. If that’s the case, the IRS requires extra reporting. This is important because failing to disclose a foreign trust can result in penalties of up to 35% of the amount contributed or distributed.

- Form 3520 is filed by a U.S. individual who owns or receives distributions from a foreign pension trust.

- Form 3520-A is the annual information return that the foreign pension administrator should file. If they don’t, the U.S. account holder may have to file it instead.

This reporting applies most often when the pension is employer-sponsored or run through a non-U.S. trust arrangement.

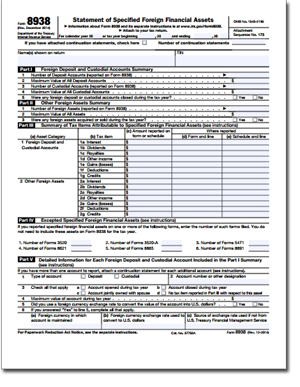

FATCA Form 8938 Requirements

The Foreign Account Tax Compliance Act (FATCA) requires U.S. taxpayers to disclose certain foreign financial assets, including pensions, on Form 8938. The thresholds depend on your filing status and whether you live in the U.S. or abroad.

For taxpayers living in the U.S.:

- Single or married filing separately: total foreign assets over $50,000 at year-end or $75,000 at any time during the year.

- Married filing jointly: total foreign assets over $100,000 at year-end or $150,000 at any time.

For taxpayers living abroad:

- Single or married filing separately: total foreign assets over $200,000 at year-end or $300,000 at any time.

- Married filing jointly: total foreign assets over $400,000 at year-end or $600,000 at any time.

Form 8938 goes with your annual tax return (Form 1040). It does not replace FBAR reporting; both may be required.

FBAR FinCEN Form 114 Obligations

If your foreign pension is held in a non-U.S. financial account, you may also need to file the FBAR using FinCEN Form 114. The rule applies when the combined value of all foreign financial accounts exceeds $10,000 at any point during the year.

Important points:

- Report each account, including pension accounts, even if the balance is low.

- All accounts must be added together to test the $10,000 threshold.

- The FBAR is filed electronically through FinCEN, not with your tax return.

Penalties for missing an FBAR can be steep, up to $10,000 per non-willful violation, and for willful violations, the penalty is the greater of $100,000 or 50% of the account balance at the time of the violation.

State Tax Implications for Foreign Pensions

Federal rules are only part of the story. Where you live in the U.S. also decides how much of your foreign pension you actually keep. Each state has its own income tax system, and not all of them follow the federal treatment of foreign pensions. This makes state-level rules an important part of tax planning for retirees.

State Conformity with Federal Treatment

Most states start with your federal adjusted gross income (AGI) as the base for their own tax calculations. This means if your foreign pension is included in AGI, the state will usually tax it as well. However, there are two key differences to keep in mind:

- Treaty recognition: Federal tax treaties can reduce or exempt pension income, but not every state honors those treaties. For example, California and New Jersey generally do not recognize U.S. tax treaties. That means pension income exempt at the federal level may still be fully taxable in those states.

- Separate state adjustments: Some states have their own modifications. For example, certain states allow limited exclusions for retirement income, but these are usually written for U.S.-based pensions and may not extend to foreign pensions.

The key takeaway: unless you live in a treaty-conforming state, don’t assume your federal treaty benefits will protect you from state taxation.

No-Income-Tax States Advantages

A handful of states do not levy any income tax at all. For retirees with foreign pensions, this can make a significant difference.

As of 2025, the following states have no state income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Two states, Tennessee and New Hampshire, do not tax wages or pensions. Tennessee phased out its tax on investment income in 2021, and New Hampshire fully repealed its interest and dividends tax starting in 2025. Living in these states means your foreign pension is only subject to federal tax. Many retirees choose to establish permanent residence (domicile) in one of these states to reduce their overall tax burden.

Additional State Reporting Considerations

Even if your state follows federal income rules, there are still a few state-specific details to consider:

- Foreign account reporting: FBAR and FATCA are federal, but some states may require you to disclose worldwide income, including pensions, even if treaty-exempt federally.

- Moving between states: If you change your residency, you may owe tax in your old state for the part of the year you lived there. Timing matters for when pension payments are received.

- Local tax differences: In states with city or local income taxes (like New York City), foreign pension income may be taxed at the local level, even if the state has separate rules.

Planning ahead for where you live and when you take distributions can prevent unexpected tax bills at the state or local level.

Planning Strategies for Foreign Pension Holders

Reporting rules tell you what to do, but good planning can help you lower the overall US tax on foreign pension income. Three areas matter most: when you take money out, where you live, and how your pension fits with foreign social security income.

Distribution Timing Strategies

The timing of your withdrawals can make a big difference. Taking pension payments in years when your other income is lower may keep you in a lower tax bracket. Large lump sums can push you into higher brackets, so spreading distributions over several years often helps. Keeping an eye on upcoming tax law changes also matters, since future rates may be higher or lower.

Residency and Domicile Planning

Where you live affects how much tax you pay. Some states do not tax pensions at all, while others may ignore treaty benefits and tax the full amount. Retirees who spend time abroad or move to a no-income-tax state can often reduce their state tax bill. Deciding on your permanent residence, or “domicile,” is an important step in long-term planning.

Coordination with U.S. Social Security

Foreign pension income can also affect how much of your Social Security is taxable. Up to 85% of Social Security benefits may be taxed if your total income, including pensions, is high enough. Pension income can also raise your Medicare premiums because these are based on your income level. Planning when to claim Social Security and when to draw from your pension can help you avoid crossing these thresholds.

Get It Right the First Time

With the Right Help From Verni Tax Law →

When it comes to foreign pensions, even a small mistake can cost you. Missing a form, misreporting income, or not understanding how the IRS views your pension can lead to penalties, audits, or double taxation. And once the IRS starts asking questions, it becomes harder to fix things. That’s why it’s important to work with someone who fully understands both the tax and legal sides of these rules.

Anthony N. Verni is an Attorney and CPA who represents clients before the IRS. He helps people deal with complex reporting issues, including foreign pensions, offshore accounts, offshore tax evasion cases, and tax treaty claims. He doesn’t just file taxes; he works through the details that others often miss and makes sure everything is handled the right way. He runs Verni Tax Law as a solo practice, which means you work directly with him. You get one-on-one support from a professional who knows how to deal with the IRS and protect your interests.

As the answer to the question, “Are foreign pensions taxable in the US?” is yes, the focus should be on how you handle the reporting. Getting it right from the start can save you from penalties, audits, and unnecessary tax costs. Get in touch to see how Anthony N. Verni can guide you through the process and make sure your foreign pension is reported the right way before it turns into a bigger issue.

FAQs

1. Can I roll a foreign pension into a U.S. IRA or 401(k)?

No, you can’t. Foreign pensions don’t follow the same rules as U.S. retirement accounts. Because of that, they don’t qualify for rollovers into IRAs or 401(k)s. If you take money out of your foreign pension, the IRS sees it as income, and you’ll need to report it and pay tax on it that year.

2. Do I have to report a foreign pension even if I haven’t taken any money out?

Yes, in most cases. Even if you haven’t received any payments yet, you might still need to report the pension account itself, especially if it earns interest or investment growth. The IRS could tax that growth each year. You may also need to file forms like FBAR or FATCA, depending on the balance in your account.

3. How do I convert foreign currency for tax reporting?

Use the official IRS exchange rates. If you get regular payments during the year, use the IRS’s average yearly rate to convert to U.S. dollars. If you get a lump sum (one-time payment), use the exchange rate on the day you received the money. These rates are published every year by the IRS.

4. What if my foreign pension plan doesn’t give me tax forms?

You still have to report the income. Just because you don’t get a Form 1099 doesn’t mean you’re off the hook. The IRS expects you to report the income anyway. Try to keep clear records of your pension statements. If they’re in another language, get them translated so you have proof if the IRS asks.

5. Are foreign military pensions taxed in the U.S.?

It depends on the country. If you’re receiving a U.S. military pension, it’s taxable no matter where you live. But if your pension comes from a foreign military, it might not be taxable, depending on whether a tax treaty exists between that country and the U.S. Some treaties give you partial or full exemption, but you’ll need to check the rules for your specific situation.