Criminal Tax Prosecutions

Paying personal expenses out of a closely held business: civil and criminal tax implications

Reporting personal expenses as businesses expenses on a tax return The justification for purchasing that…

Fraudulent Tax Resolution Companies

Promises Too Good To Be True In 1931, the famous jurist, Benjamin Nathan Cardozo, in…

IRS warns against using Ghost Tax preparers

Large Tax Refunds: Are they too good to be true? The IRS has long cautioned…

New Voluntary Disclosure Practice for willful u.s. taxpayers

Termination of OVDP and way forward Following the termination of the Offshore Voluntary Disclosure Program…

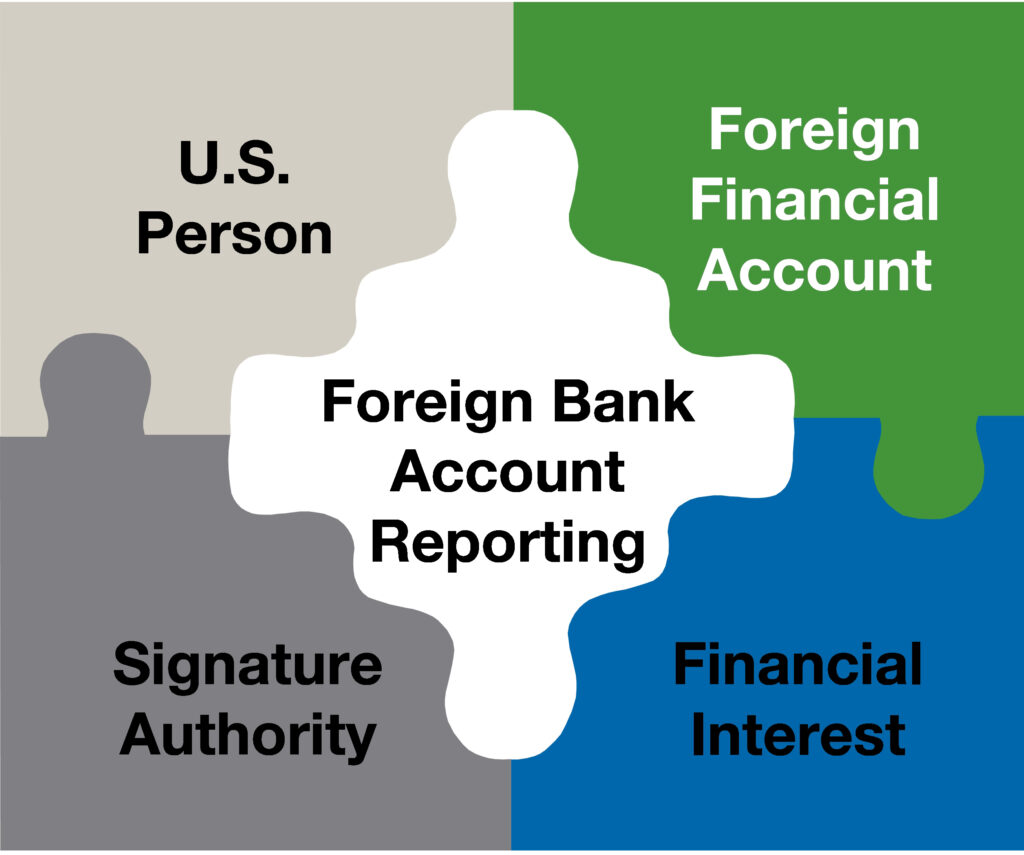

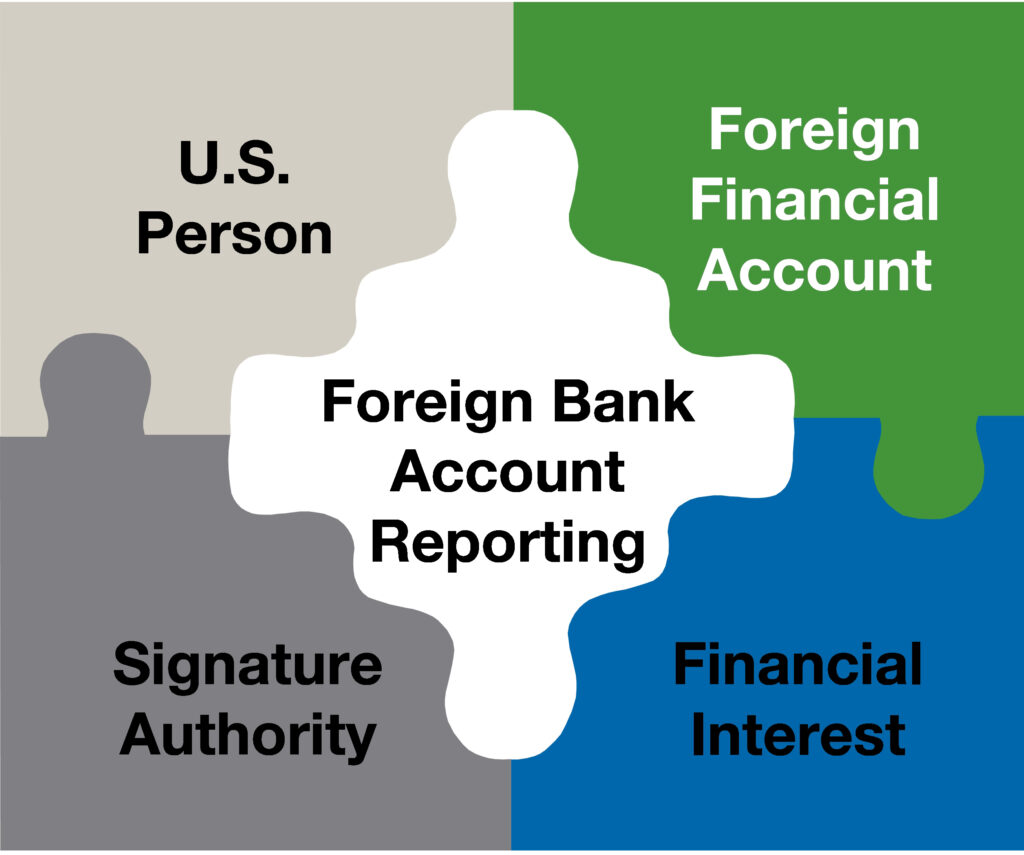

The Willful FBAR Penalty: Is it Limited to $100,000? Not so Fast.

Assessment of FBAR penalty Some practitioners have applauded the decision in United States v. Colliot,…

Willful FBAR Penalty- Legal Decisions Diminish Taxpayer Prospects for Successful Defense.

Case Facts. April 3, 2018, the U.S. District Court in United States v. Garrity held…

The Non-willful FBAR Penalty and the Slow Death of Reasonable Cause.

Non Willful FBAR Penalty Ruling. A December 2017 decision of the Court of Federal Claims…

Immigration and Lying on your Tax Return: The Quickest way to deportation.

Lying on tax return as an immigrant. The IRS has identified a rise in the…

Tax Attorney Sentenced To 48 Months For Employment Tax Fraud

Pittsburgh Tax Attorney Gets 48 Months For Employment Tax Fraud On January 12, 2017 Steven…

New Developments in The Willful Civil FBAR Penalty

Current Developments May Make It Easier For the IRS To Assess Penalties After Willfully Failing…

Tax Evasion: No One Is Immune From Prosecution

The U.S Department of Justice, Tax Division:Federal Tax Prosecutions Continue Unabated Many taxpayers are skeptical…

Taxation of Professional Athletes & Entertainers – Are You At Risk?

The Risks of Professional Athlete and Entertainer Taxation Global sports and entertainment have created many…