Criminal Tax Prosecutions

Offshore Tax Compliance Prosecutions by the IRS

Offshore Tax Compliance Update – Recent IRS Tax Prosecutions The following convictions represent recent successful…

Delinquent IRS Trust Fund Taxes Update

The Trust Fund Penalty for Delinquent IRS Trust Fund Taxes If you owe back payroll…

Michigan Man Pleads Guilty To Tax Obstruction

“ANOTHER KNUCKLEHEAD BITES THE DUST” The definition of a Knucklehead is“someone considered to be of…

Outrunning the IRS: FBAR Statute of Limitations Guidelines

What Happens If Someone Fails to File an FBAR? A wrinkle in the law for…

Money Laundering Is Tax Evasion

Money Laundering and Tax Evasion Money laundering and tax evasion are closely related. The IRS…

FBAR Enforcement: How and When the IRS Will Act?

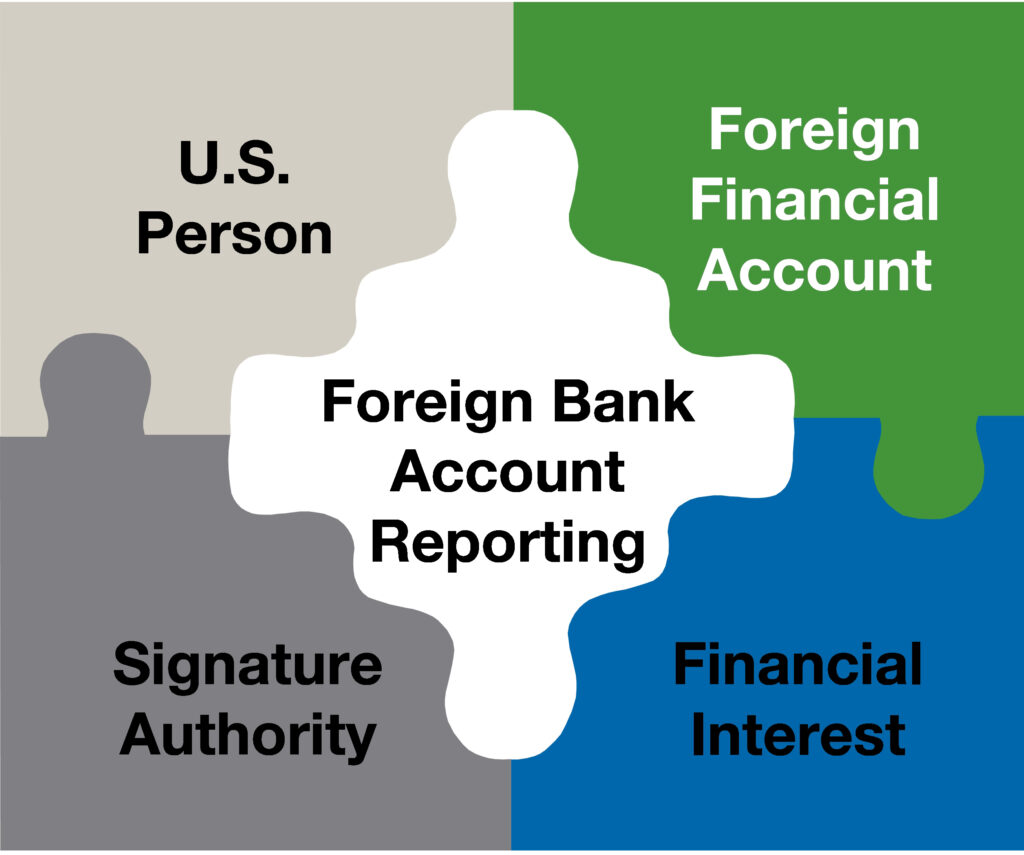

How Does the IRS Enforce the FBAR? The Report of Foreign Bank and Financial Accounts,…

No 5th Amendment Privilege in Submission of Foreign Bank Accounts Records

The US District Court for the District of New Jersey has applied the required records…

Tax Resolution Firms – Scams and Scoundrels

There are many reasons why clients with Tax issues with the IRS should avoid the…

FATCA, Transparency Efforts Curb Offshore Tax Evasion

FATCA, Transparency Efforts Curb Offshore Tax Evasion

Everyone’s Getting FATCA Compliant The worldwide landscape of transparency is changing as the United States…

FBAR Failure Leads Connecticut Executive to Plead Guilty to $8.4 Million Tax Evasion

Prosecutors announced Jan. 20 that a Connecticut business executive has pleaded guilty to willfully failing…

Secret Foreign Bank Accounts Are Not Secret Anymore…

Secret Foreign Bank Accounts Secret foreign bank accounts have been at the center of money…

United States vs Simon in Failure to file FBARs

Failure to file FBARs as a Signatory Authority Failure to file FBARs as a Signatory…