News

Tax Resolution Firms – Scams and Scoundrels

There are many reasons why clients with Tax issues with the IRS should avoid the…

FATCA, Transparency Efforts Curb Offshore Tax Evasion

FATCA, Transparency Efforts Curb Offshore Tax Evasion

Everyone’s Getting FATCA Compliant The worldwide landscape of transparency is changing as the United States…

Global Tax Transparency Rises as FATCA, OECD Initiatives Gain Momentum

As the growth of global tax transparency rises, individual taxpayers and financial institutions must exercise…

IRS Clarifies Rules on FATCA Announcement

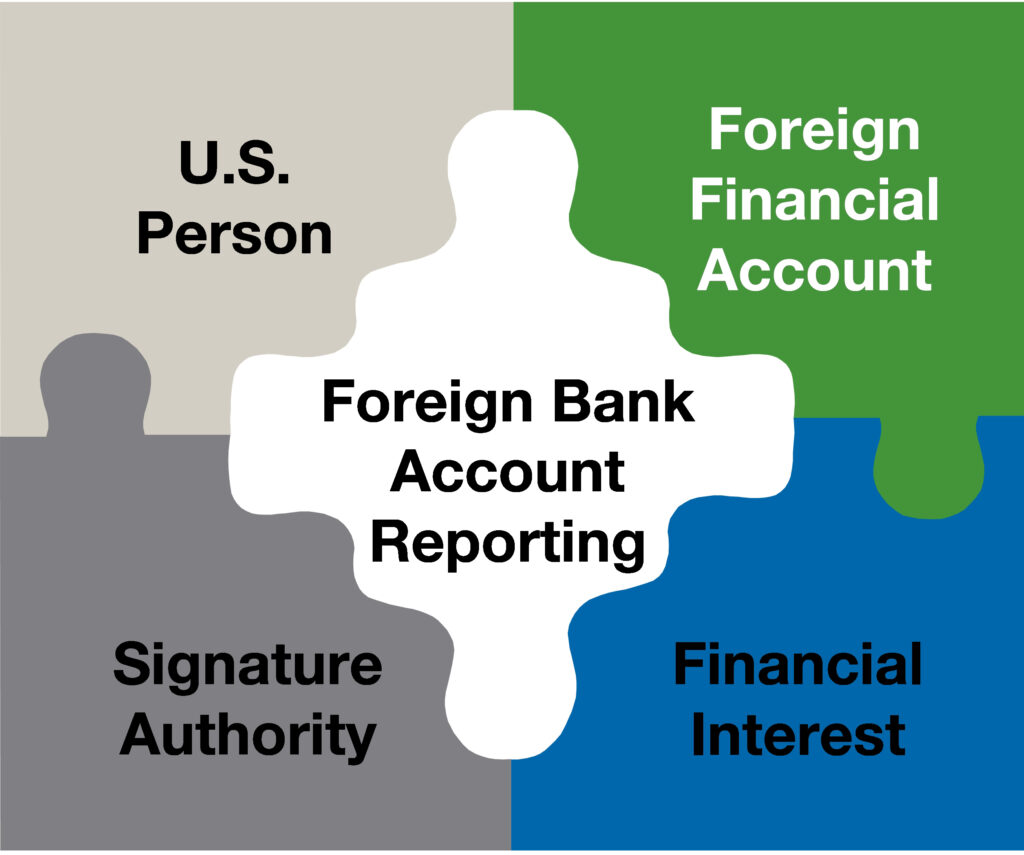

FBAR Failure Leads Connecticut Executive to Plead Guilty to $8.4 Million Tax Evasion

Prosecutors announced Jan. 20 that a Connecticut business executive has pleaded guilty to willfully failing…

Secret Foreign Bank Accounts Are Not Secret Anymore…

Secret Foreign Bank Accounts Secret foreign bank accounts have been at the center of money…

United States vs Simon in Failure to file FBARs

Failure to file FBARs as a Signatory Authority Failure to file FBARs as a Signatory…

IRS modifications to OVDP and streamlined procedures a Relief to offshore bank account holders

IRS modifications to OVDP and streamlined procedures The Offshore Voluntary Compliance Program Internal Revenue Service’s…

FBAR Case on United States v. Carl Zwerner settled for $1.8 Million

FBAR Case: United States vs. Carl Zwerner is settled for $1.8 Million The United States…

IRS Deadline for U.S. Citizens and Resident Aliens Abroad

IRS Expectations of U.S. Citizens and Resident Aliens Abroad IRS (Internal Revenue Service) in one…

Tax Evasion Not Cured with QI Pacts

Tax Evasion under QI agreements On Feb. 28 2014, Thomas Sawyer, senior counsel on international…

Tax Evasion Causes Cash Abroad to Rise

Tax Evasion and Profits US-based companies added $206 billion to their offshore profits last year,…