OVDP

FBAR PROSECUTIONS-FORMER CFO SENTENCED TO EIGHTY SIX MONTHS IN PRISON

On September 21, 2023 a former CFO of a Russian natural gas company was sentenced…

Offshore Disclosure of Foreign Financial Accounts: Deciding What Road to Take

Disclosing Offshore Bank Accounts Taxpayers who are considering coming out of the shadows to disclose…

DOJ Announces Indictment of Taxpayer for Filing False Non-Willful Certification Under the Federal Streamlined Procedures

Case Background On August 27, 2019 the Department of Justice (DOJ) announced a superseding indictment…

New Voluntary Disclosure Practice for willful u.s. taxpayers

Termination of OVDP and way forward Following the termination of the Offshore Voluntary Disclosure Program…

Willful FBAR penalty Case Study.

Wilfull FBAR Penalty. The following is intended as an update to my January 26, 2019…

Streamline Disclosures- The Art of the Non-Willful Certification.

Offshore disclosure to IRS. The key to making an offshore disclosure to the IRS using…

The Willful FBAR Penalty: Is it Limited to $100,000? Not so Fast.

Assessment of FBAR penalty Some practitioners have applauded the decision in United States v. Colliot,…

Willful FBAR Penalty- Legal Decisions Diminish Taxpayer Prospects for Successful Defense.

Case Facts. April 3, 2018, the U.S. District Court in United States v. Garrity held…

OVDP Coming to an End Soon

Internal Revenue Service plans to close the Offshore Voluntary Disclosure Program (OVDP) on September 18, 2018.…

FBAR Collections Ten Billion and Counting

IRS Releases 2016 Offshore Voluntary Compliance Statistics On October 21, 2016 the IRS released the…

Money Laundering Is Tax Evasion

Money Laundering and Tax Evasion Money laundering and tax evasion are closely related. The IRS…

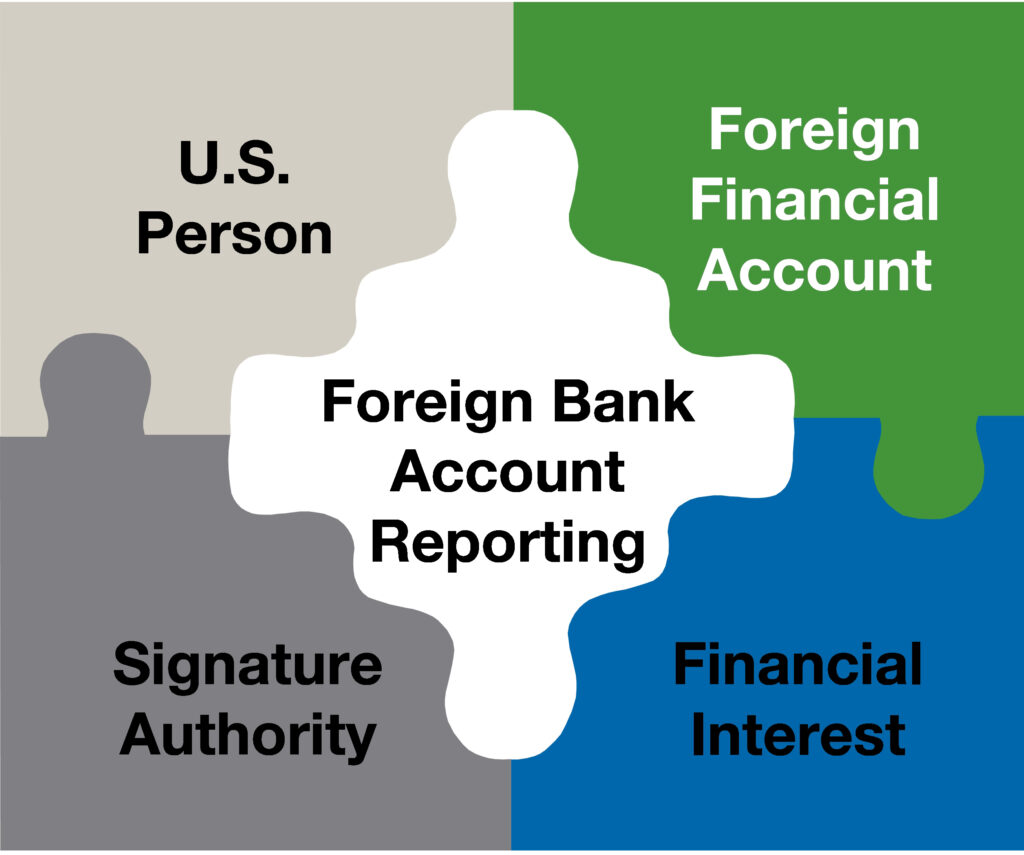

OVDP Lawyer — Protect Yourself Against OVDP Crackdown by the IRS

About The Offshore Voluntary Disclosure Program (OVDP) US citizens and residents are required to report foreign…