FBAR: Foreign Bank Account Report

FBAR (Report of Foreign Bank and Financial Accounts) requires U.S. citizens and permanent residents to report their overseas bank and financial accounts. Under the Bank Secrecy Act, these accounts must be reported to the IRS annually.

Filing the FBAR (Report of Foreign Bank Accounts) How to Find the Best

Who is supposed to file an FBAR?

An FBAR should be filed by U.S. citizens and permanent residents who have:

- A bank account with a value of more than $10,000 at any time during the year

- An aggregate value of more than $10,000 in all their foreign accounts at any time during the year

- A signatory authority over at least one Foreign Financial account

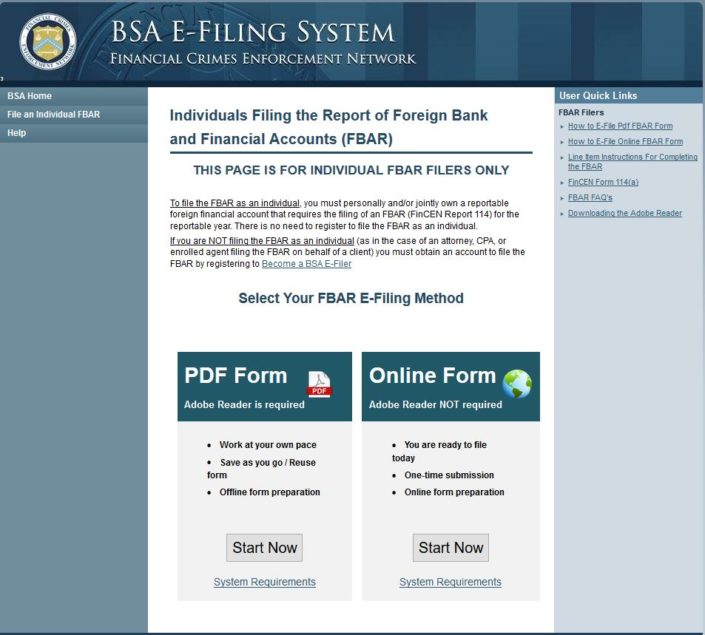

How do I file an FBAR?

What happens if I don’t report my Foreign Financial Accounts on an FBAR?

- Up to $10,000 for each non-willful violation. This means that you did not intentionally avoid reporting your foreign accounts. The penalty is for each account and each of the years you did not file an FBAR.

- Up to $100,000 for each willful violation or 50 percent of the amount in the account for each violation in each of the years you didn’t file an FBAR.

- The penalty can sometimes be so serious like $250,000 or even 5 years in prison or both. See 31 U.S.C 5322(a)

What if I have several years of unreported FBARs?

Hear from relieved

Taxpayers who trusted Verni Tax Law

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Ken B.

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Douglas R.

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Phil Y

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Yassin and Eva, B.

Have questions or need guidance?

I’m always available by phone, email, or Skype whatever’s easiest for you.

Take the first step and let me help fix the root of your tax problems.