Offshore Bank Accounts

Offshore Disclosure of Foreign Financial Accounts: Deciding What Road to Take

Disclosing Offshore Bank Accounts Taxpayers who are considering coming out of the shadows to disclose…

DOJ Announces Indictment of Taxpayer for Filing False Non-Willful Certification Under the Federal Streamlined Procedures

Case Background On August 27, 2019 the Department of Justice (DOJ) announced a superseding indictment…

Michigan Man Pleads Guilty To Tax Obstruction

“ANOTHER KNUCKLEHEAD BITES THE DUST” The definition of a Knucklehead is“someone considered to be of…

FBAR Failure Leads Connecticut Executive to Plead Guilty to $8.4 Million Tax Evasion

Prosecutors announced Jan. 20 that a Connecticut business executive has pleaded guilty to willfully failing…

Secret Foreign Bank Accounts Are Not Secret Anymore…

Secret Foreign Bank Accounts Secret foreign bank accounts have been at the center of money…

United States vs Simon in Failure to file FBARs

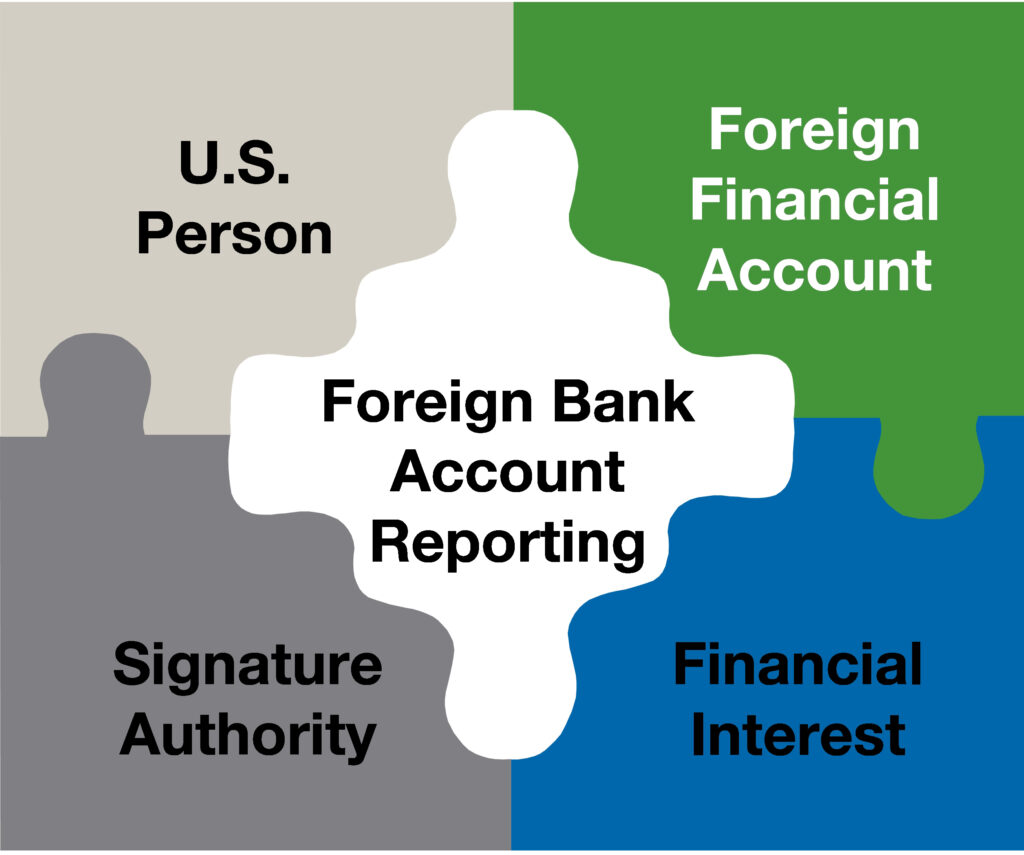

Failure to file FBARs as a Signatory Authority Failure to file FBARs as a Signatory…

IRS modifications to OVDP and streamlined procedures a Relief to offshore bank account holders

IRS modifications to OVDP and streamlined procedures The Offshore Voluntary Compliance Program Internal Revenue Service’s…

FBAR Case on United States v. Carl Zwerner settled for $1.8 Million

FBAR Case: United States vs. Carl Zwerner is settled for $1.8 Million The United States…