tax evasion

Bank Fraud and Criminal Tax Charges Against Michael Avenatti

Michael Avenatti’s Indictment The temptation to use unfilled or altered tax returns as well as…

Paying personal expenses out of a closely held business: civil and criminal tax implications

Reporting personal expenses as businesses expenses on a tax return The justification for purchasing that…

Tax Evasion: No One Is Immune From Prosecution

The U.S Department of Justice, Tax Division:Federal Tax Prosecutions Continue Unabated Many taxpayers are skeptical…

Money Laundering Is Tax Evasion

Money Laundering and Tax Evasion Money laundering and tax evasion are closely related. The IRS…

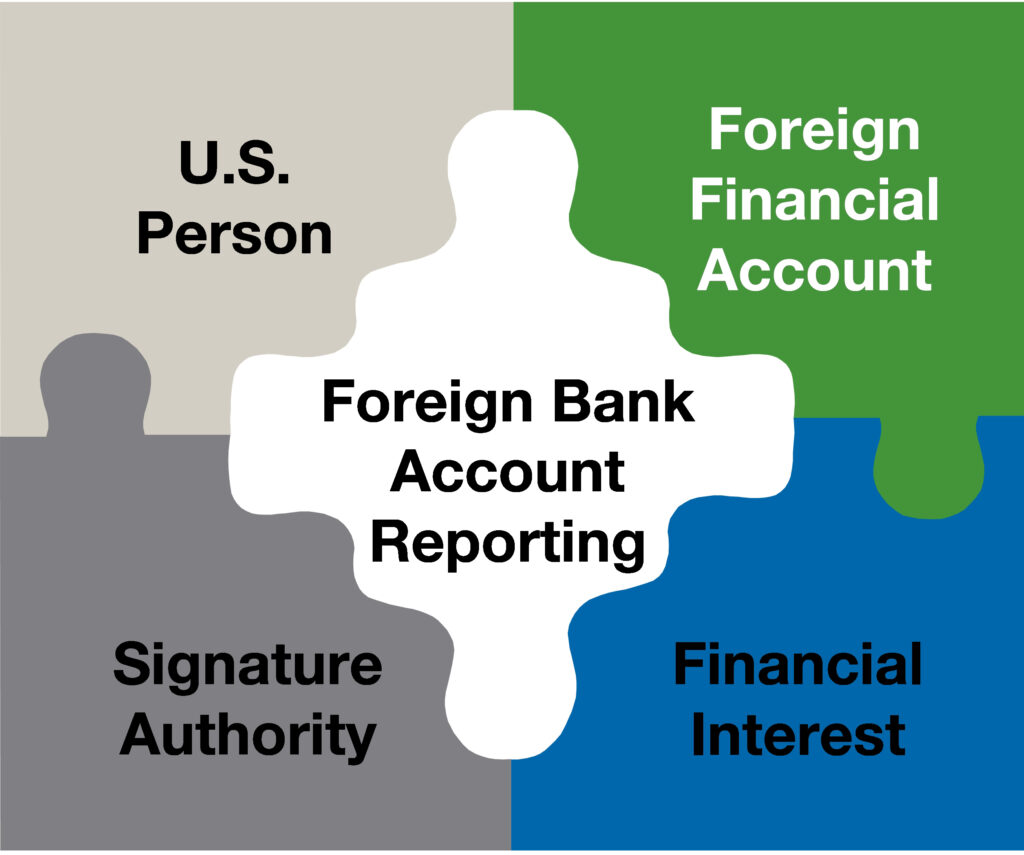

United States vs Simon in Failure to file FBARs

Failure to file FBARs as a Signatory Authority Failure to file FBARs as a Signatory…

IRS to Modify OVDP to Accommodate Non-willful tax evasion

OVDP changes to accommodate non-willful tax evasion The OVDP (Offshore Voluntary Disclosure Program) may face…

IRS Deadline for U.S. Citizens and Resident Aliens Abroad

IRS Expectations of U.S. Citizens and Resident Aliens Abroad IRS (Internal Revenue Service) in one…

Tax Evasion Not Cured with QI Pacts

Tax Evasion under QI agreements On Feb. 28 2014, Thomas Sawyer, senior counsel on international…

Tax Evasion Causes Cash Abroad to Rise

Tax Evasion and Profits US-based companies added $206 billion to their offshore profits last year,…