Law Office News

Paying personal expenses out of a closely held business: civil and criminal tax implications

Reporting personal expenses as businesses expenses on a tax return The justification for purchasing that…

Divorce Tax Rule Changes

New rules in Tax Cuts and Jobs Act With the enactment of the Tax Cuts and…

IRS Urges Businesses To E-File Cash Transaction Reports

Electronic Filing For Businesses In an effort to promote compliance, on February 19, 2019 the…

Delinquent Expat Filers and Facilitators: Are you in Trouble?

Introduction Expatriates (Expats) who continue to ignore their obligations to file U.S. Federal Income Tax…

Trust Fund Recovery Penalty

The Trust Fund Recovery Penalty: Are You At Risk? Introduction The assessment of the §…

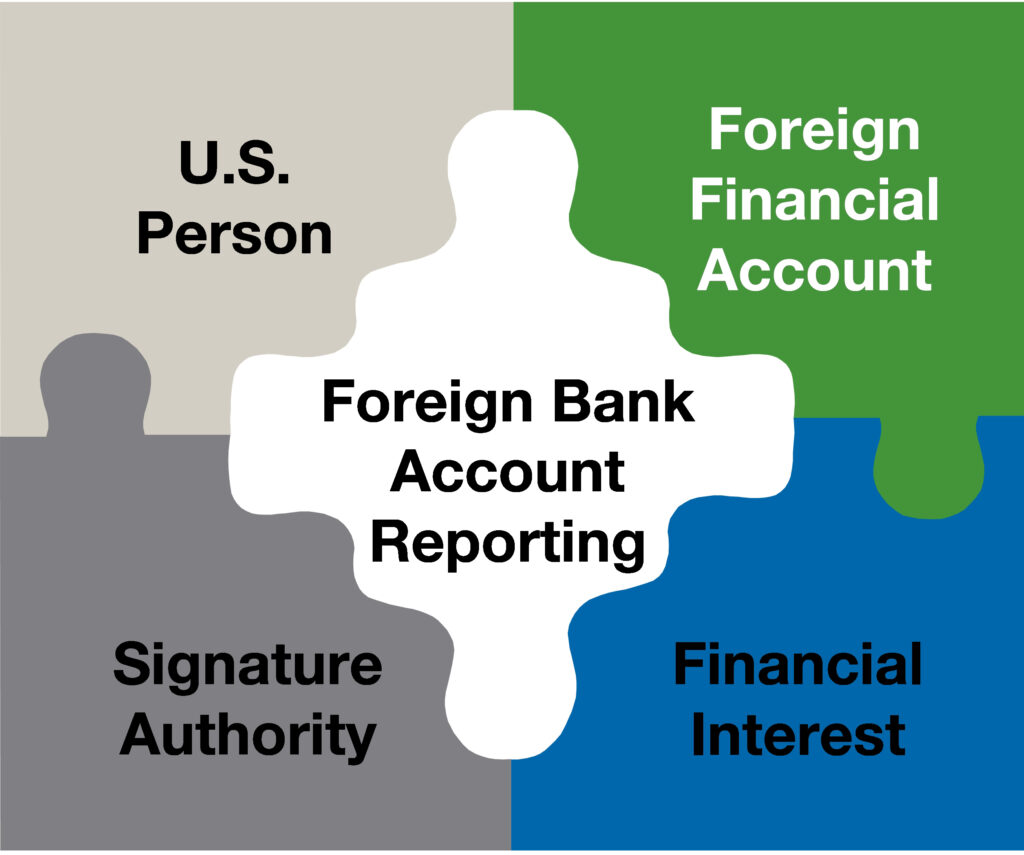

Willful FBAR penalty Case Study.

Wilfull FBAR Penalty. The following is intended as an update to my January 26, 2019…

Streamline Disclosures- The Art of the Non-Willful Certification.

Offshore disclosure to IRS. The key to making an offshore disclosure to the IRS using…

The Willful FBAR Penalty: Is it Limited to $100,000? Not so Fast.

Assessment of FBAR penalty Some practitioners have applauded the decision in United States v. Colliot,…

Self Employed Tax Schemes That Always Fail

If you are self-employed and recently received an examination notice from the Internal Revenue Service…

Unfiled Income Tax Returns “Come Into The Light”.

Serial Tax Return Non-filers. Every year, thousands of individuals fail to file their Federal and…

Willful FBAR Penalty- Legal Decisions Diminish Taxpayer Prospects for Successful Defense.

Case Facts. April 3, 2018, the U.S. District Court in United States v. Garrity held…

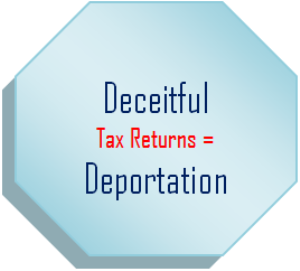

Immigration and Lying on your Tax Return: The Quickest way to deportation.

Lying on tax return as an immigrant. The IRS has identified a rise in the…