IRS Urges Businesses To E-File Cash Transaction Reports

Electronic Filing For Businesses

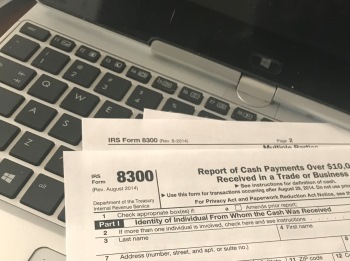

In an effort to promote compliance, on February 19, 2019 the IRS urged businesses that are required to file reports of large cash transactions to take advantage of the electronic filing option that was announced on September 19, 2012 by The Financial Crimes Enforcement Network (FinCEN). Under federal law a person who is engaged in a trade or business must file Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business) within 15 days after a transaction (IRC 6050I; 26 CFR 1.6050I-1(e); 31 USC 5331; 31 CFR 1010.330). Although businesses still have the option of filing Form 8300 on paper, electronic filing has several benefits. One of the benefits is that electronic filing is convenient and cost effective. It is also a secure way of transmitting sensitive financial information. Similarly, by filing Form 8300 electronically, businesses are able to receive immediate acknowledgement of receipt when filing is completed.

In an effort to promote compliance, on February 19, 2019 the IRS urged businesses that are required to file reports of large cash transactions to take advantage of the electronic filing option that was announced on September 19, 2012 by The Financial Crimes Enforcement Network (FinCEN). Under federal law a person who is engaged in a trade or business must file Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business) within 15 days after a transaction (IRC 6050I; 26 CFR 1.6050I-1(e); 31 USC 5331; 31 CFR 1010.330). Although businesses still have the option of filing Form 8300 on paper, electronic filing has several benefits. One of the benefits is that electronic filing is convenient and cost effective. It is also a secure way of transmitting sensitive financial information. Similarly, by filing Form 8300 electronically, businesses are able to receive immediate acknowledgement of receipt when filing is completed.

The filing requirement for Form 8300 authorized under Internal Revenue Code Section 6050I pre-dates the enactment of Section 5331 under the Bank Secrecy Act (BSA). Section 5331 enacted in 2001 requires non-financial trades or businesses to file Form 8300. In 2001 Treasury Regulations were issued permitting a single Form 8300 to satisfy both the Title 26 and Title 31 filing requirements.

Who is required to file?

Although the term “person” is defined differently under Titles 26 ad 31, the regulations under both titles expressly incorporate the definition of “person” under Section 7701 of the Internal Revenue Code to include an individual, trust, estate, partnership, association, company or corporation. The term “trade or business” generally includes any activity carried on for the production of income from selling goods or performing services. It is not limited to integrated aggregates of assets, activities, and goodwill that comprise businesses for purposes of certain other provisions of the Internal Revenue Code. Activities of producing or distributing goods or performing services from which gross income is derived do not lose their identity as trades or businesses merely because they are carried on within a larger framework of other activities that may, or may not, be related to the organization’s exempt purposes.

What payments need to be reported?

While the Internal Revenue Code requires reporting cash receipts, Section 5331 of the BSA requires the reporting of receipts of coins or currency. The definition of “cash” under Treasury Regulation 26 CFR 1.6050l-1 (c) (1) is similar to the definition of “currency” under Title 31.

Under the Treasury Regulations the term “cash” includes:

- Coin and currency of the United States or any other country which circulates and is accepted as money in the country in which it is issued

- A cashier’s check, bank draft, traveler’s check or money order having a face amount of not more than $10,000 that is (1) received in a designated reporting transaction, or (2) received in any transaction in the which the recipient knows that the instrument is being used in an attempt to avoid the reporting of the transaction

Under Title 31 the term “currency” is defined to include foreign currency and to the extent provided in the regulations proscribed by the Secretary, any monetary instrument with a face amount of not more than $10,000, except a check drawn on the account of the writer in most financial institutions. 31 CFR 1010.330(c)(1).

While there are stiff civil and, in some cases, criminal penalties associated with failing to file Form 8300, a report issued by the Treasury Inspector General for Tax Administration (“TIGTA”) on September 24, 2018 concluded that the BSA Program has had a minimal impact on compliance. Nevertheless, if you are required to file Form 8300 you should be concerned and take action.

The takeaway here is that the IRS has streamlined the filing process for Form 8300 by permitting electronic filing. By doing so, businesses should take advantage of this process in lieu of paper filing, which remains an option. Those who fail to file Form 8300 may find it difficult to explain the reason for non-compliance in light of the electronic filing option. Failing to file Form 8300 may also create risk particularly where a financial institution has filed a Suspicious Activity Report (“SAR”) in connection with a transaction which should have been reported on Form 8300. In the event an SAR is filed there is a possibility that you will be identified by the IRS and be subject to their scrutiny. The impetus behind requiring the filing of a cash transaction report is to promote compliance and establish money trails and expose hidden criminal trends and patterns that include money laundering and terrorist financing.