Tax Compliance

IRS Urges Businesses To E-File Cash Transaction Reports

Electronic Filing For Businesses In an effort to promote compliance, on February 19, 2019 the…

IRS warns against using Ghost Tax preparers

Large Tax Refunds: Are they too good to be true? The IRS has long cautioned…

Trust Fund Recovery Penalty

The Trust Fund Recovery Penalty: Are You At Risk? Introduction The assessment of the §…

Streamline Disclosures- The Art of the Non-Willful Certification.

Offshore disclosure to IRS. The key to making an offshore disclosure to the IRS using…

Unfiled Income Tax Returns “Come Into The Light”.

Serial Tax Return Non-filers. Every year, thousands of individuals fail to file their Federal and…

The Non-willful FBAR Penalty and the Slow Death of Reasonable Cause.

Non Willful FBAR Penalty Ruling. A December 2017 decision of the Court of Federal Claims…

Immigration and Lying on your Tax Return: The Quickest way to deportation.

Lying on tax return as an immigrant. The IRS has identified a rise in the…

Case Where Texas Ranchers Were Victorious in IRS Appeal

Dallas Appeals Officer Reverses IRS DecisionAllows Business Expenses and Ranching Losses for 2011 & 2012…

Expatriate Tax Advice: What Are the Filing Requirements for U.S. Expats?

What U.S. Expats Need to Know About IRS Filing Requirements Many expatriates have questions about…

Publication 519: What You Need to Know

What You Need to Know About IRS Publication 519 Publication 519 is provided by the…

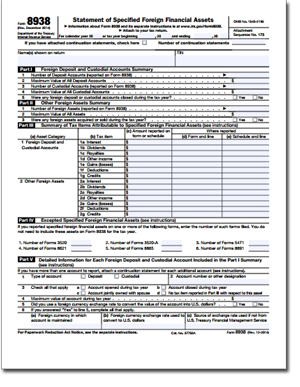

Form 8938: The Statement of Specified Foreign Financial Assets

In an effort to curb tax dodging by United States citizens with foreign assets, Congress…