IRS

Cash Intensive Businesses & the IRS; a marriage made in Hell

Cash intensive businesses Operating a cash intensive business is often accompanied by poor record keeping…

IRS Urges Businesses To E-File Cash Transaction Reports

Electronic Filing For Businesses In an effort to promote compliance, on February 19, 2019 the…

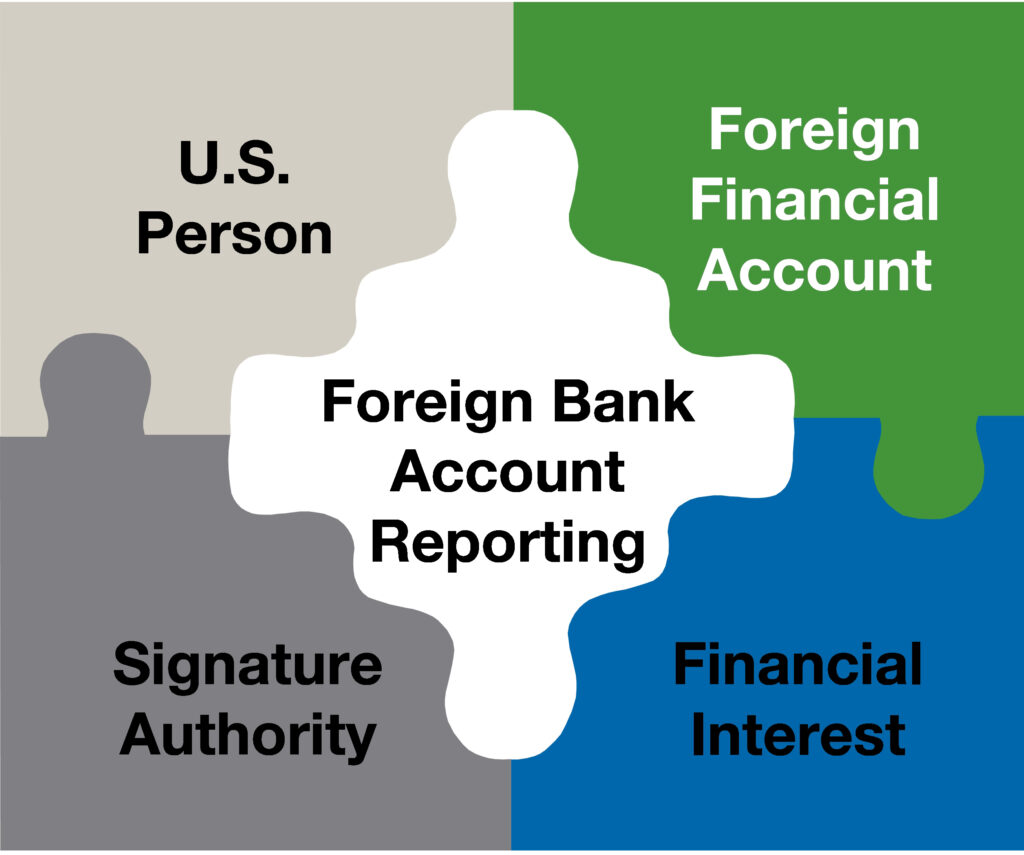

New Developments in The Willful Civil FBAR Penalty

Current Developments May Make It Easier For the IRS To Assess Penalties After Willfully Failing…

Delinquent IRS Trust Fund Taxes Update

The Trust Fund Penalty for Delinquent IRS Trust Fund Taxes If you owe back payroll…

FBAR Collections Ten Billion and Counting

IRS Releases 2016 Offshore Voluntary Compliance Statistics On October 21, 2016 the IRS released the…

Money Laundering Is Tax Evasion

Money Laundering and Tax Evasion Money laundering and tax evasion are closely related. The IRS…

IRS modifications to OVDP and streamlined procedures a Relief to offshore bank account holders

IRS modifications to OVDP and streamlined procedures The Offshore Voluntary Compliance Program Internal Revenue Service’s…

IRS to Modify OVDP to Accommodate Non-willful tax evasion

OVDP changes to accommodate non-willful tax evasion The OVDP (Offshore Voluntary Disclosure Program) may face…

IRS Deadline for U.S. Citizens and Resident Aliens Abroad

IRS Expectations of U.S. Citizens and Resident Aliens Abroad IRS (Internal Revenue Service) in one…

Don’t pack your bags just yet

Don’t pack your bags just yet; you may not be going anywhere. The Senate bill…