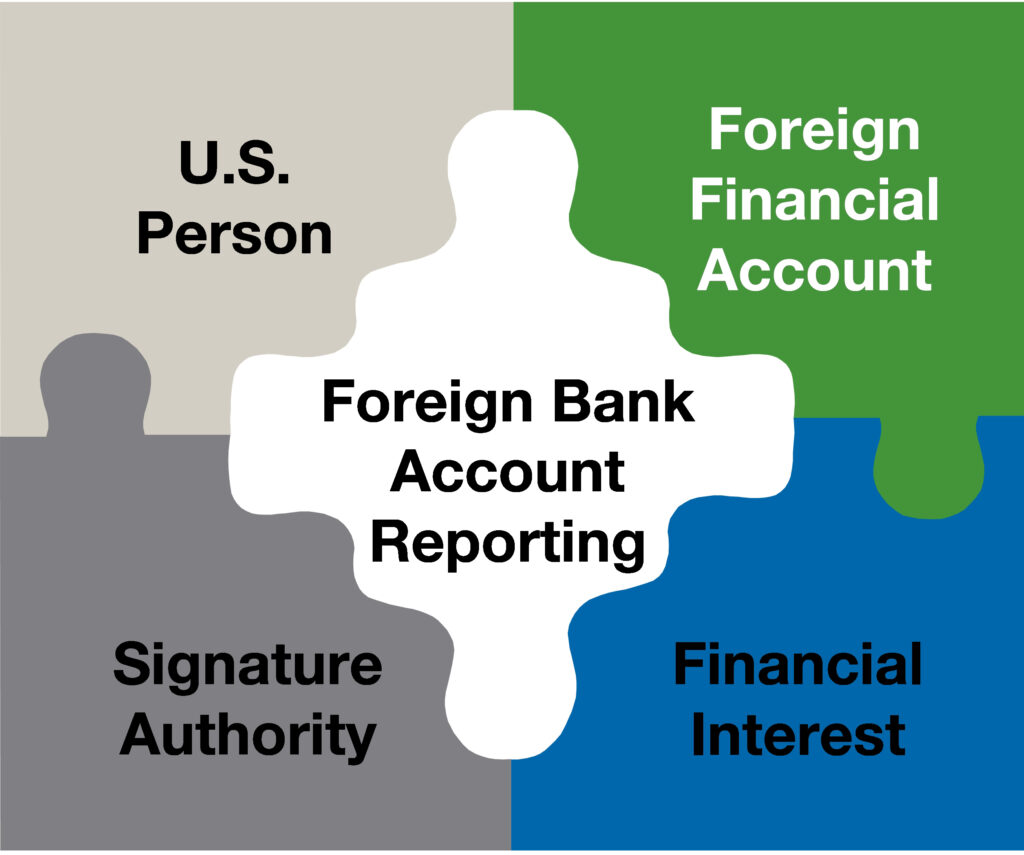

Failure to file FBARs as a Signatory Authority

Failure to file FBARs as a Signatory Authority to a foreign bank account is an offense punishable by law according the to the Bank Secrecy Act.

The U.S. Court of Appeals for the Seventh Circuit affirmed the conviction of an Indiana CPA/Accounting professor by a U.S. District Court in United States vs Simon, 7th Cir, No. 11-01837. The conviction was based upon the taxpayer’s filing false income tax returns, failure to file FBARs (Foreign Bank Account Reports), mail fraud and financial aid fraud. One of the four FBAR counts related to Simon failure to file FBARs (reports on foreign bank accounts) for which he was a signatory for the years 2002 through 2007. During this time period he was the managing director of three foreign companies and had signatory authority over foreign bank accounts of these companies. The companies included: The Simon Family Trust based in the Cook Islands, Elekta Ltd, a Gibralter company and JS Elekta, a Cyprus corporation.

Charges on Failure to File FBARs

Simon was charged with four counts of failure to file FBARs related to foreign bank accounts according to 31 U.S.C. §§ 5314, 5322. For the years 2005 through 2007, Simon conceded he was required to file a form TDF 90-22.1 now FinCEN Form 114 by June 30th for the foreign bank accounts aggregating more than $10,000 in the previous years. He also admitted that he failed to do so. However, Simon argued that he did not violate the law.

Simon’s defense

According to Simon, the IRS issued guidance in 2009 and 2010 that granted retroactive extensions for filing FBARs for the year 2008 and preceding years. This guidance was issued through IRS notices. Taking the notices into consideration, Simon asserted that he filed the required FBARS prior to his indictment. He insisted that he did the filing within the deadlines set forth in the notices 2009‐62 and 2010‐23 and could therefore not face prosecution on failing to meet the original deadlines.

Government’s standing

The Government maintained that Simon’s crimes were complete before the IRS issued the notices. According to the government, Simon could not use the notices to exonerate himself from crimes he had already committed before the notices came into play. According to the Government,

“amendment of a regulation does not relieve the taxpayer of criminal liability for conduct that occurred before the amendment even when the amendment purports to have retroactive application.”

In addition, nothing in the notices promised relief from criminal liability for taxpayers who willfully failed to file FBARs. The only relief in the notices was that the IRS would not impose civil penalties for taxpayers whose failure to comply was non-willful.

Evaluation Points

- Setting up and using foreign corporations, trusts and other devices for purposes of hiding foreign funds never works and can be viewed as strong evidence of “willfulness” in an FBAR prosecution.

- Masking transfers from foreign corporate and other third party accounts as “loans” can be used by the Government as strong evidence on intent in a criminal tax prosecution.

- The facts in the Simon Case involved a wilful failure to file FBARs.