Filing the FBAR (Report of Foreign Bank Accounts)

FBAR refers to Report of Foreign Bank and Financial Accounts. The reporting of Foreign and Financial Bank accounts applies to U.S. citizens and permanent residents with bank accounts overseas. The Bank Secrecy Act that these bank and financial accounts should be reported to the IRS every year.

FBAR refers to Report of Foreign Bank and Financial Accounts. The reporting of Foreign and Financial Bank accounts applies to U.S. citizens and permanent residents with bank accounts overseas. The Bank Secrecy Act that these bank and financial accounts should be reported to the IRS every year.

A Foreign Financial Account may include; a bank account, brokerage account, mutual fund account, trusts account etc.

Who is supposed to file an FBAR?

An FBAR should be filed by U.S. citizens and permanent residents who have:

- A bank account with a value of more than $10,000 at any time during the year

- An aggregate value of more than $10,000 in all their foreign accounts at any time during the year

- A signatory authority over at least one Foreign Financial account

As long as you are a U.S. citizen either residing overseas or in the U.S. and you have a financial account (as noted above) in another country, you are supposed to report this on an FBAR. It is interesting to note that income on foreign accounts should be reported to, even if the value of the account or accounts aggregates is less than $10,000. For detailed information on this, click here.

How do I file an FBAR?

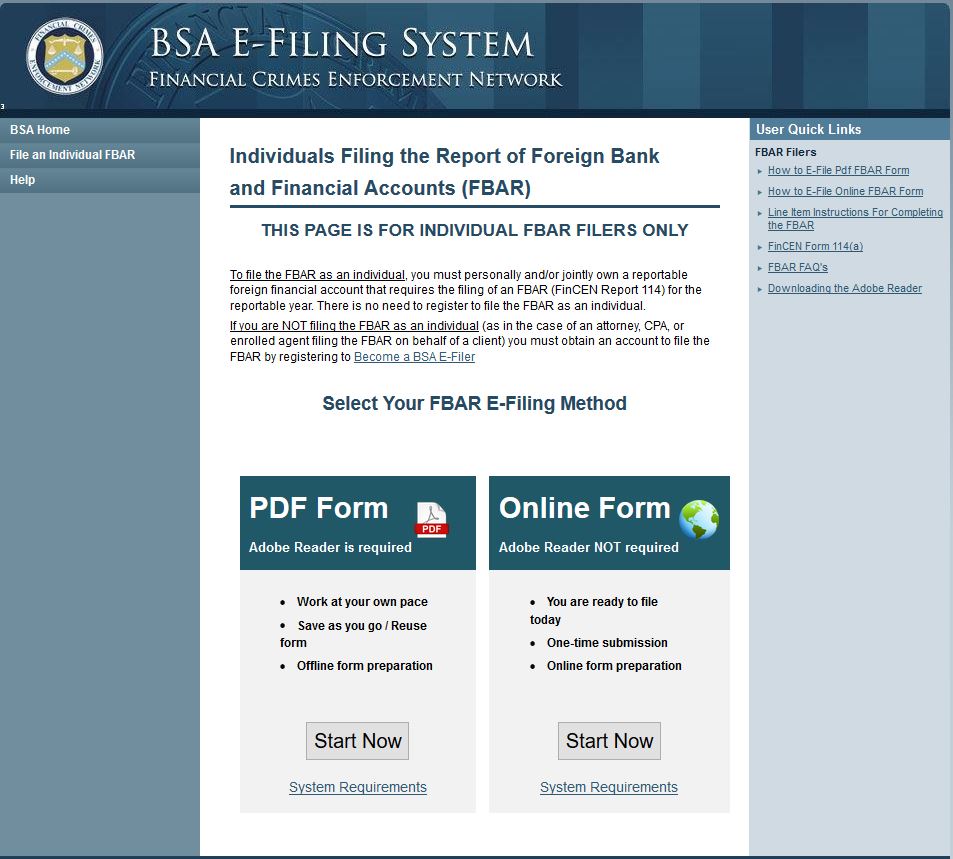

U.S. citizens or permanent residents with foreign financial accounts meeting the reporting criteria as outlined above should report the accounts on an FBAR form. In addition to this are corporations or trusts or estates formed under the U.S. law. Initially, form TDF 90-22.1 was used for the reporting. This has however been replaced by FinCEN Form 114. This form is only accessible online through the BSA E-Filing website. This means that an FBAR report can only be filed online through the BSA website. You can do this personally or you can contract the services of a third party. In case of using a third party, FinCEN Form 114a is required. This is a form that authorizes a third party to file your FBAR. The filing should be done every year by June 30th.

U.S. citizens or permanent residents with foreign financial accounts meeting the reporting criteria as outlined above should report the accounts on an FBAR form. In addition to this are corporations or trusts or estates formed under the U.S. law. Initially, form TDF 90-22.1 was used for the reporting. This has however been replaced by FinCEN Form 114. This form is only accessible online through the BSA E-Filing website. This means that an FBAR report can only be filed online through the BSA website. You can do this personally or you can contract the services of a third party. In case of using a third party, FinCEN Form 114a is required. This is a form that authorizes a third party to file your FBAR. The filing should be done every year by June 30th.

There is no extension on this date as there is for federal income tax.

What happens if I don’t report my Foreign Financial Accounts on an FBAR?

Failure to file an FBAR may result in significant penalties. The penalties may include:

- Up to $10,000 for each non-willful violation. This means that you did not intentionally avoid reporting your foreign accounts. The penalty is for each account and each of the years you did not file an FBAR.

- Up to $100,000 for each willful violation or 50 percent of the amount in the account for each violation in each of the years you didn’t file an FBAR.

- The penalty can sometimes be so serious like $250,000 or even 5 years in prison or both. See 31 U.S.C 5322(a)

What if I have several years of unreported FBARs?

The best way to solve this problem is to come forward under Offshore Voluntary Disclosure Program. This program gives the tax payers an opportunity to disclose their foreign bank accounts before the IRS gets to them. The program is the best option for people who have not reported their offshore accounts for years as it offers reduced penalties.