All or Nothing – Trust Fund Recovery Penalty under Section 6672

Many business owners believe that operating as a Corporation protects them from personal liability.

While oftentimes this is true, if a corporation does not pay income tax withholding and withheld Social Security, the IRS can and will pursue…

Expatriate Tax Advice: What Are the Filing Requirements for U.S. Expats?

What U.S. Expats Need to Know About IRS Filing Requirements

Many expatriates have questions about how to handle their taxes while living abroad. There are many things to consider such as: Do I have to file U.S. income tax return? What about…

Publication 519: What You Need to Know

What You Need to Know About IRS Publication 519

Publication 519 is provided by the Internal Revenue Service (IRS) to assist in tax preparation for both resident and non-resident aliens. Among other things Publication 519 helps you to determine…

Doubling Down: How an International Tax Lawyer Can Save You From Double Taxation

How Tax Lawyers Can Help Prevent Double Taxation Confusions

The notion of an international tax attorney conjures up images of Grand Cayman and John Grisham’s “The Firm,” but the need for a tax lawyer who specializes is international tax…

Finding an FBAR Lawyer to Help Avoid Criminal Charges

How to Find a Good Tax Attorney

You’ve discovered you have to file the Foreign Bank Account Report but are having trouble finding an FBAR attorney. As you search across the web, it may seem as though there are attorneys for any number of…

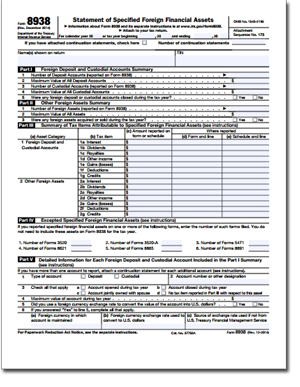

Form 8938: The Statement of Specified Foreign Financial Assets

In an effort to curb tax dodging by United States citizens with foreign assets, Congress passed The Hiring Incentives to Restore Employment Act.

The act imposes a new reporting requirement for foreign financial assets, in addition to the requirement…

No 5th Amendment Privilege in Submission of Foreign Bank Accounts Records

The US District Court for the District of New Jersey has applied the required records doctrine to documents required to be maintained under the US Bank Secrecy Act (BSA), and thus rejected taxpayers' argument that they can refuse to produce…

Tax Resolution Firms – Scams and Scoundrels

There are many reasons why clients with Tax issues with the IRS should avoid the use of Tax Resolution firms.

The "Tax Resolution Company", a relatively recent development, has become a serious problem for consumers in our country and is…