FBAR Penalty Representation

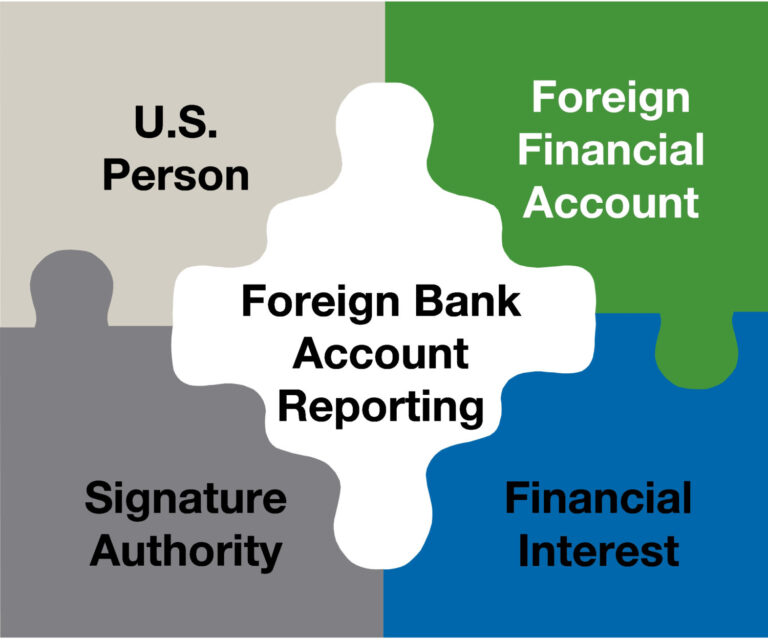

Many U.S. citizens and residents hold foreign accounts, investments, or property, and since the IRS is closely monitoring offshore assets, any accounts that exceed certain thresholds must be reported each year to the Treasury by filing FinCEN Form 114 (FBAR).

FBAR Tax Attorney:

What US Expats Need to Know About Tax Solutions

What is an FBAR?

Who has to file an FBAR?

- the United States person had a financial interest in or signature authority over at least one financial account located outside of the United States; and

- the aggregate value of all foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

Additionally, corporations, partnerships, or limited liability companies, created or organized in the United States or under the laws of the United States; and trusts or estates formed under the laws of the United States must file a FBAR.

Are There Any Exceptions to the FBAR?

Why do I need an FBAR attorney?

Without a representation by a tax attorney, the IRS will easily gain access to your personal and financial records to build a case against you. Representing yourself in an IRS investigation will most likely lead to higher penalties and fees.

Frequently Asked Questions

What is the statute of limitations for tax fraud cases?

cover the general 6-year criminal statute of limitations, exceptions for continuing conspiracies, and the unlimited period for civil fraud penalties.

How can I tell if I'm under criminal investigation by the IRS?

should detail specific signs like special agent visits, third-party contact notices, and grand jury subpoenas.

What's the difference between tax avoidance and tax evasion?

As both an attorney and CPA with an MBA, I offer a rare combination of legal, accounting, and business expertise that most tax resolution firms cannot provide. Unlike other firms, I personally handle every case from start to finish. My boutique practice approach ensures meticulous attention to detail and customized strategies based on your specific risk profile, rather than applying one-size-fits-all solutions.

How does Verni Tax Law stand out from other tax resolution firms in the USA?

As both an attorney and CPA with an MBA, I offer a rare combination of legal, accounting, and business expertise that most tax resolution firms cannot provide. Unlike other firms, I personally handle every case from start to finish. My boutique practice approach ensures meticulous attention to detail and customized strategies based on your specific risk profile, rather than applying one-size-fits-all solutions.

How does Verni Tax Law stand out from other tax resolution firms in the USA?

As both an attorney and CPA with an MBA, I offer a rare combination of legal, accounting, and business expertise that most tax resolution firms cannot provide. Unlike other firms, I personally handle every case from start to finish. My boutique practice approach ensures meticulous attention to detail and customized strategies based on your specific risk profile, rather than applying one-size-fits-all solutions.

How does Verni Tax Law stand out from other tax resolution firms in the USA?

As both an attorney and CPA with an MBA, I offer a rare combination of legal, accounting, and business expertise that most tax resolution firms cannot provide. Unlike other firms, I personally handle every case from start to finish. My boutique practice approach ensures meticulous attention to detail and customized strategies based on your specific risk profile, rather than applying one-size-fits-all solutions.

How does Verni Tax Law stand out from other tax resolution firms in the USA?

As both an attorney and CPA with an MBA, I offer a rare combination of legal, accounting, and business expertise that most tax resolution firms cannot provide. Unlike other firms, I personally handle every case from start to finish. My boutique practice approach ensures meticulous attention to detail and customized strategies based on your specific risk profile, rather than applying one-size-fits-all solutions.

How does Verni Tax Law stand out from other tax resolution firms in the USA?

As both an attorney and CPA with an MBA, I offer a rare combination of legal, accounting, and business expertise that most tax resolution firms cannot provide. Unlike other firms, I personally handle every case from start to finish. My boutique practice approach ensures meticulous attention to detail and customized strategies based on your specific risk profile, rather than applying one-size-fits-all solutions.

Table of contents

Hear from relieved

taxpayers who trusted Verni Tax Law

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Ken B.

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Douglas R.

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Phil Y

Anthony was creative in helping me resolve some past issues in a way that they never became a problem so that is greatly appreciated and I feel confident I can now enjoy my retirement with peace of mind. Thanks for that.

Yassin and Eva, B.

Have questions or need guidance?

I’m always available by phone, email, or Skype whatever’s easiest for you.

I’m always available by phone, email, or Skype whatever’s most convenient for you. Whether you’re feeling uncertain about your next steps, overwhelmed by IRS correspondence, or simply seeking trusted, experienced advice, I’m here to listen and help you understand your options.

Don’t wait to get the relief and clarity you deserve. Take the first step today, and let me help you identify and resolve the root causes of your tax challenges once and for all. Together, we’ll create a clear, personalized plan to restore your peace of mind and move forward with confidence.

Take the first step and let me help fix the root of your tax problems.