Criminal prosecution

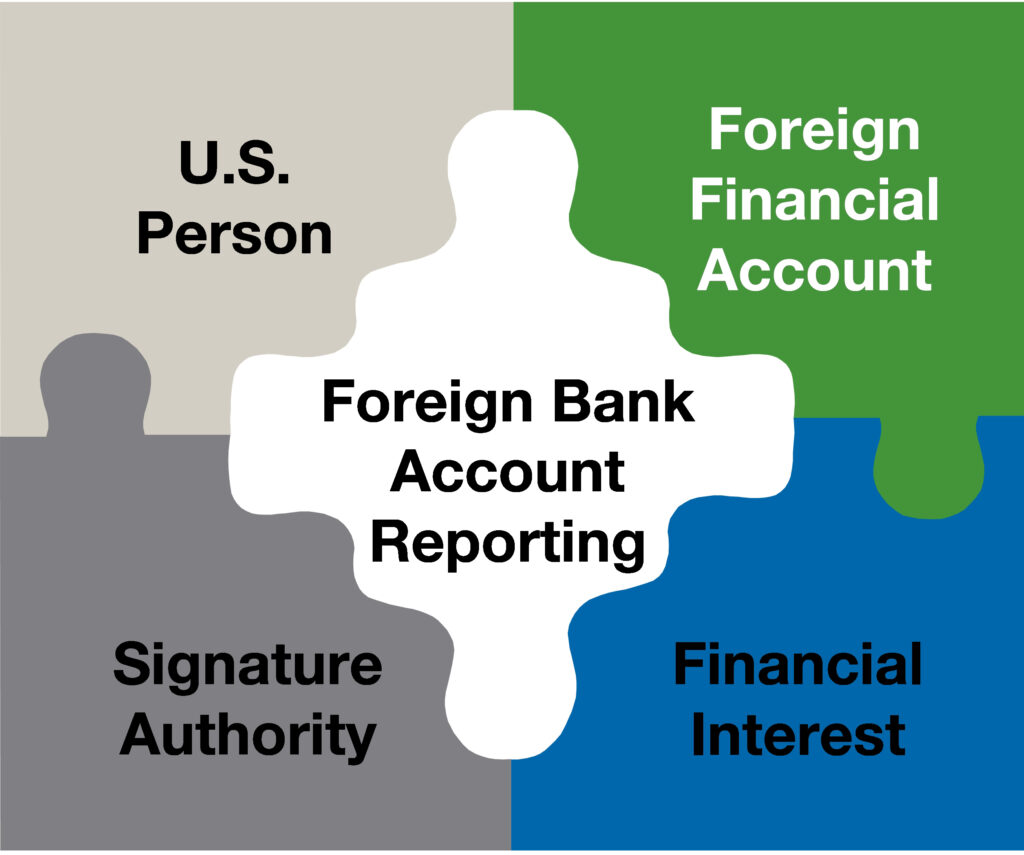

Former Harvard Chemistry Chair indicted for failing to file FBAR and filing false tax returns

IRS Hard at Work Despite the Pandemic Individuals, who have failed to report their foreign…

Quiet Disclosure Guilty Plea

Florida man pleads guilty to tax evasion and hiding funds around the world In April…

Bank Fraud and Criminal Tax Charges Against Michael Avenatti

Michael Avenatti’s Indictment The temptation to use unfilled or altered tax returns as well as…

Trust Fund Recovery Penalty; Consequences of Fraudulent Conveyances

Fraudulent Conveyances in Employment Taxes Employers who willfully fail to remit an employee’s withholding to…

Remember the Large IRS Tax Refunds? You May Have To Pay Them Back.

Fraudulent IRS tax refunds Each year thousands of individuals flock to tax return preparation centers…

Paying personal expenses out of a closely held business: civil and criminal tax implications

Reporting personal expenses as businesses expenses on a tax return The justification for purchasing that…

Tax Attorney Sentenced To 48 Months For Employment Tax Fraud

Pittsburgh Tax Attorney Gets 48 Months For Employment Tax Fraud On January 12, 2017 Steven…

New Developments in The Willful Civil FBAR Penalty

Current Developments May Make It Easier For the IRS To Assess Penalties After Willfully Failing…

Tax Evasion: No One Is Immune From Prosecution

The U.S Department of Justice, Tax Division:Federal Tax Prosecutions Continue Unabated Many taxpayers are skeptical…

Delinquent IRS Trust Fund Taxes Update

The Trust Fund Penalty for Delinquent IRS Trust Fund Taxes If you owe back payroll…

Michigan Man Pleads Guilty To Tax Obstruction

“ANOTHER KNUCKLEHEAD BITES THE DUST” The definition of a Knucklehead is“someone considered to be of…

Finding an FBAR Lawyer to Help Avoid Criminal Charges

How to Find a Good Tax Attorney You’ve discovered you have to file the Foreign…